Today the Dow dropped 544 points on the heels of the Lehman bankruptcy, Merrill’s sale to BofA and AIG’s scramble for cash ….if that weren’t enough to signal a crisis, the co-founder of the Blackstone Group/former head of Lehman/secretary of commerce in the Nixon administration resorted to using to out-of-caricature language such as ”My goodness.” This must be extraordinary.

So naturally, I did what any Series 7 licensed financial services professional would do: I escaped to the gym to furiously spin to – I can’t believe I’m admitting this – The Scorpions, among other songs of note…. (note to everyone: you must see my new favorite movie, “Burn After Reading,” to appreciate the intellectual stimulation of the gym environment, among a plethora of other things pertinent to life as we know it).

As I’ve long attested, there is nothing like a little ’80s rock to get the neurons firing (lest you accuse me of rationalizing my shallow need for endorphins…you win). Nevertheless, it was on the bike that I:

- Reaffirmed my sense that our financial system as fueled by publicly-traded institutions is positioned for vulnerability to behaviors incented by short-term rewards structures (read: speculative, opportunistic balance-sheet manipulations are rewarded in the quarterly business cycles).

- Underscored the tension of “moral hazard” that exists when institutions yield such a powerful influence across a wide range of society, leading to impunity for reckless behavior in the name of salvaging the assets of a broader swath of the population.

Is further regulation the answer to these 2 issues? As my new hero*, economist Nouriel Roubini put it, ““You either nationalize the banks or you nationalize the mortgages,” he said. “Otherwise, they’re all toast.”” That said, I’m never one to advocate regulation as a panacea for human shortfalls (and economic activity is merely the product of human behavior). All regulation does is transfer accountability from one entity – the private sector – to another human entity – the public sector. With enough time, the players always find a way to circumvent the intended structures put into place.

Of the two steps already being considered – (1) the Fed lending against more assets, including stocks, thus providing an additional cushion for a troubled firm; and (2) the banks setting up a facility to buy assets from troubled firms in the future; – the first doesn’t address the moral hazard issue; and the second will only be as good as the banks will eventually allow it to be used.

Hearken back to nearly 100 years ago, when, per the NYT, J.P. Morgan purportedly called the heads of all the trust companies to a meeting in his library and “demanded that they agree to put up money to stop the bank run at another trust company. The bankers did not want to do so, in part because they would need that money if the panic spread. Morgan locked the door, and kept the presidents in the library until morning, when they finally gave in. No such coercion exists this year.” (aside: looks like my quest for character …as it entails making noble choices when under pressure.. is timeless…).

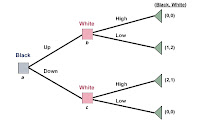

In light of these bleak realities, can we at least hope for the prevailing of the Nash equilibrium (yes, that Nash that most Americans associate with Russell Crowe), which purports that “The incentive to defect

Dunno – I just timed out. Time to blogroll Bourini!

[*who is, btw, my hero not only because he is an economist – the smartest human beings alive who can also never be wrong …see, smart!… but also coined a phrase that captured my heart: “delusional complacency” – yes!!!]